Strategic consultancy firm Eight Advisory has today launched a new Takeup Tracker, which examines the steady rise in take-up across the UK’s many alternative full fibre broadband (altnet) networks and compares it with that of incumbent operator Openreach (BT). The new tracker paints a mixed picture, albeit one with some positives to share.

Overall, altnet penetration has slowly increased over the last 6 months, along with their focus on profitability. While some continue to build at pace, many altnets have slowed or stopped build during 2024. Altnet penetration at aggregate level was estimated to be 17% in September 2024 (up 1 point from the 16% reported in May 2024). But there remains significant variation between providers and individual cohorts.

In the same timeframe, Openreach’s FTTP take-up rose to 35% (up 3 points since May 2024), which is despite the operator accelerating build as they “continue to enjoy an incumbency advantage for new orders and migrations that comes from accessing 80% of the retail market” (via major ISPs like BT (EE, Plusnet), TalkTalk, Sky Broadband and Vodafone etc.). This is important as 90% of the Consumer ISP market continues to be served by just five large brands.

Openreach are clearly doing well above, as a rapid network roll-out will often contribute to help suppress take-up figures, particularly when expressed as a percentage (i.e. build will often add premises at a greater rate than customers can adopt it). The loss of customers can also cause take-up figures to fall.

However, despite Openreach’s strength and the challenging market environment (high interest rates, rising build costs and competition), some altnets have clearly been making progress. For example, CommunityFibre, Fibrus and Ogi have all exceeded the 25% take-up mark. On the flip side, Hyperoptic’s take-up seems to have fallen from 30% in 2021 to 20% today, which isn’t explained in the report (but it could be at least partly due to the ‘stop-and-start’ phasing of their build, as well as some customer bleeds in existing areas).

At a market level, broadband retail pricing was also found to be down by 4% in real terms in the year to September 2024, as competition hots up for new customers. But overbuild between networks is “becoming increasingly challenging“, with Thinkbroadband previously publishing analysis showing 69% of premises had FTTP networks – with 22% having two networks, 2.8% with three and 0.2% with four. This makes growing take-up harder.

Despite the aforementioned issues, altnets are still collectively – albeit slowly – stealing customers away from some of the established ISP brands, although it should be pointed out that both TalkTalk and Vodafone do sell packages via more than just Openreach. For example, Vodafone also sells via Cityfibre, and so does TalkTalk (Sky will join them later this year), but TalkTalk also works with several other altnets. Suffice to say that expressing altnets as one group, as occurs in the chart below, may not be fully representative.

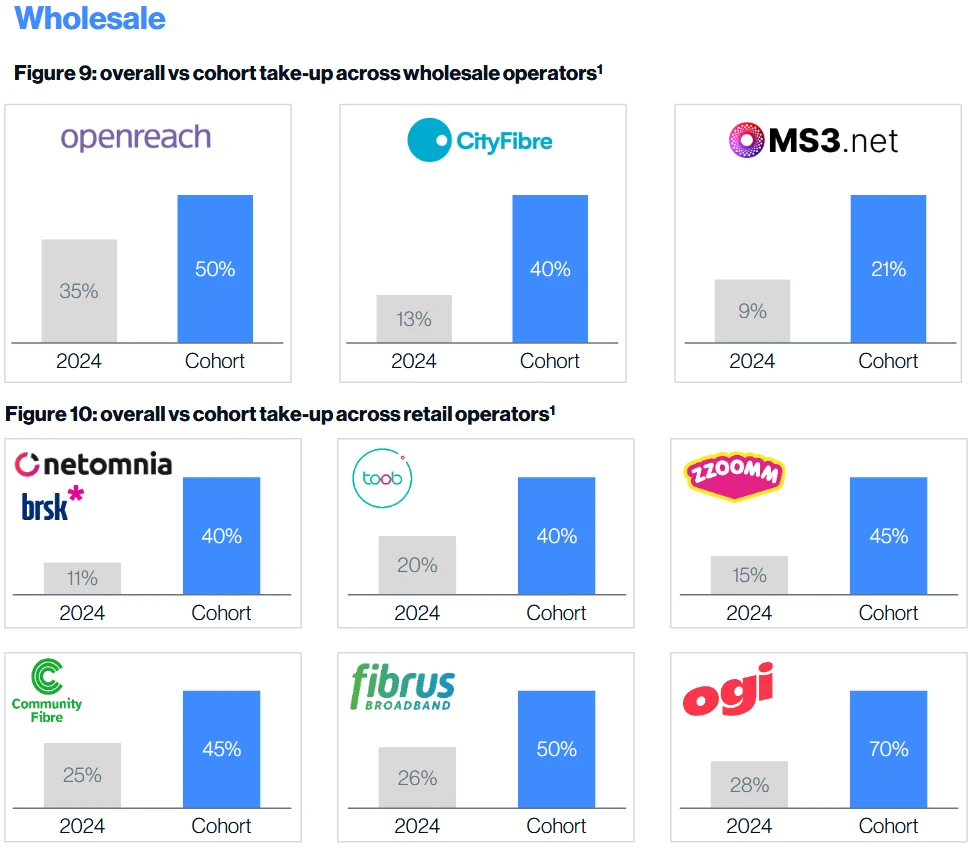

The new Takeup Tracker and associated report doesn’t only look at the aggregated totals and also, for the first time, includes a cohort analysis. A cohort typically refers to a group of customers that are part of a specific phase in the network roll-out or marketing campaign. Each operator will define the customer cohorts differently, thus like-for-like comparisons remain difficult.

The consultancy firm interviewed senior leaders across UK operators to understand cohort-level detail and has included some data from that, albeit framed with the aforementioned caveat. For example, following discussion with Netomnia’s (inc. Brsk) CEO, the report noted how they now have three of their more mature cohorts achieving high take-up levels, above 30%. Some other vertically integrated Altnets have also been able to achieve cohort performance between c.40-70%.

Netomnia also added a similar number of subscribers to Vodafone in Q3 2024 through their YouFibre & Brsk ISPs, making them the fastest growing ISP of any size. “With Altnet total adds of 160k, they are taking around a 30% of the adds from about 15% of the Altnet footprint,” said the report.

Meanwhile, BT (Openreach) report over 50% take-up on their oldest cohorts, which date back to June 2020. In Milton Keynes, CityFibre’s most mature market, where the build programme started in 2018 and completed in 2022, more than 30% of the homes have already chosen to move over to CityFibre’s network with the first areas served at approximately 40% with growth month-on-month.

Clearly, given enough time and the right locations, altnets can attract plenty of interest and punch above their weight, which will get them closer to the take-up levels needed for EBITDA breakeven and profitability.

Adam Bradley, Partner & European Telecoms Lead at Eight Advisory, said:

“Driving Take-up to improve profitability and achieve breakeven is the top priority of most altnets and a critical consideration for the many active fibre financing and refinancing processes.

With the slowdown of build for many in 2024, the expected market consolidation is also taking longer than many expected. In the meantime, many altnets continue to outperform their national market share expectations at a local cohort level.”

At the time of writing, we don’t yet have the link to Eight Advisory’s new Takeup Tracker (it wasn’t live), but we’ll aim to add this shortly.