Network testing firm Ookla (i.e. Speedtest.net, Downdetector.co.uk) has today published an interesting new report that examines the adoption and performance of 5G Standalone (5GSA) based mobile broadband networks across the UK and Europe. This also compares the new technology against existing Non-Standalone (NSA) 5G networks.

Just for some context. 5G SA networks are pure end-to-end 5G connections that remove the legacy of slower 4G connectivity (still present in current NSA networks) and can thus deliver lower latency times, greater energy efficiency, better upload speeds, network slicing, improved support for Internet of Things (IoT) devices, support for Voice over New Radio (VoNR or Vo5G) and increased reliability and security etc.

Vodafone was the first UK mobile operator to launch 5GSA technology during mid-2023 (here), and they’ve since been followed by both EE (BT) and O2 (Virgin Media). By contrast, we have spotted several Three UK sites with 5G SA support, but they haven’t yet officially launched this service and are instead aligning their deployment plans with Vodafone as part of the recently agreed merger.

As usual, customers need supporting hardware (mobile handsets / routers etc.) in order to benefit from 5GSA. The initial focus of all these deployments has also tended to be on the busiest parts of various UK cities and large towns, although until now we haven’t seen a lot of data on the real-world performance difference between newer 5GSA and older NSA networks.

Comparing 5G SA and NSA Performance

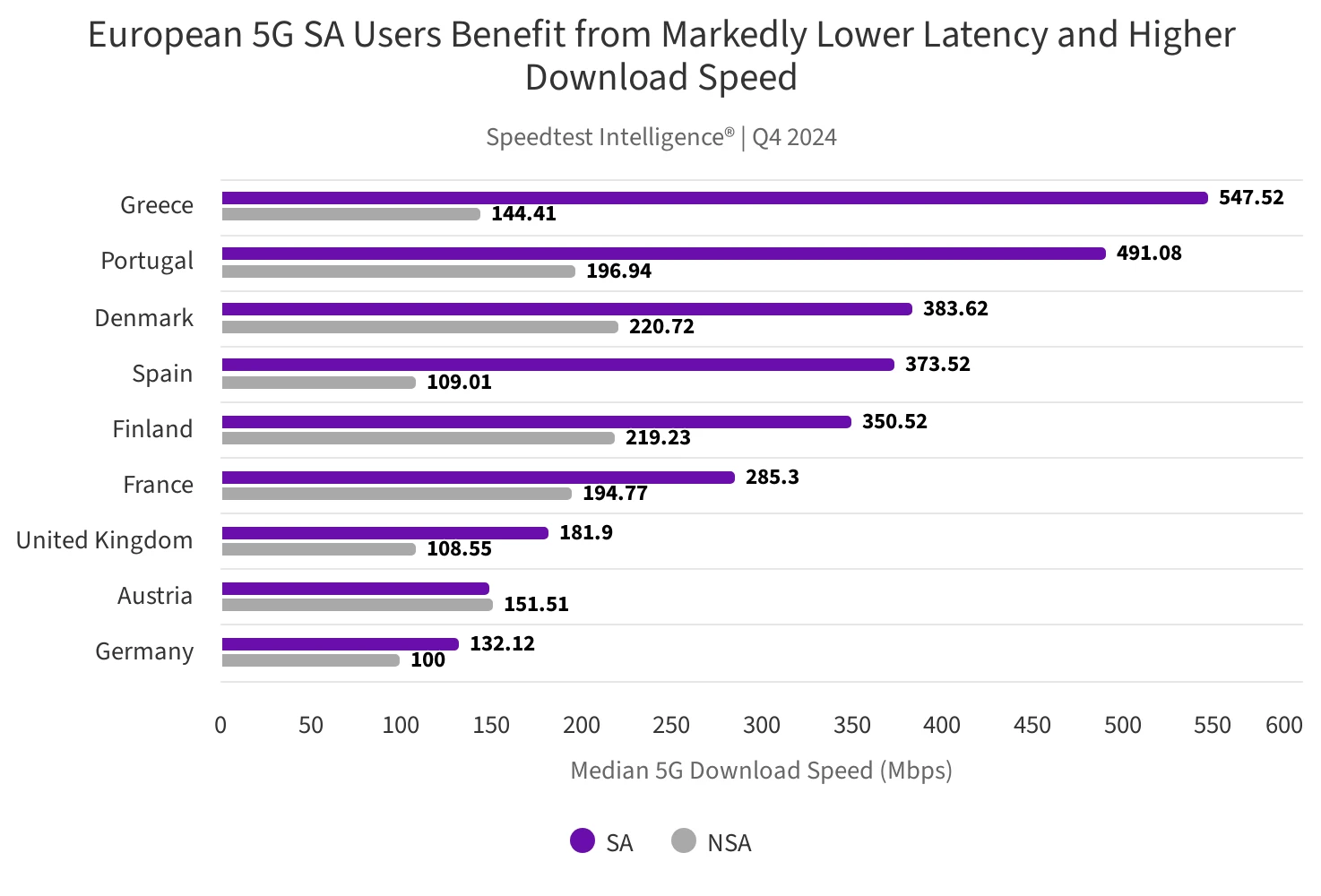

The good news is that Ookla’s new report (PDF), which evaluates the UK and Europe’s progress on 5GSA deployments with other parts of the world (conducted in collaboration with Omdia), does finally give us a look at the key performance differences it can bring. The list of countries isn’t very long below because many have yet to start major 5GSA deployments.

For example, in terms of median download speeds (Megabits per second), regular 5G NSA networks in the UK delivered 108.55Mbps but on SA networks this jumps to 181.9Mbps. Some countries, such as Greece, show an even bigger performance gap, which is often due to the accompanying released of additional radio spectrum bands. On the flip side, the UK still sits quite low in the table below.

“Within Europe, while 5G SA rollout progress remains highly varied, the best outcomes have been observed in countries that have specific policies intended to incentivize 5G SA deployment. Germany, the United Kingdom, and Spain—all four-player markets benefiting from targeted 5G SA-specific fiscal stimuli or coverage obligations— lead Europe in terms of 5G SA rollout across multiple operators,” said Ookla (this is clearly more of a reference to coverage than network performance).

Meanwhile, Southern and Central European countries have supplanted the Nordics at the forefront of this phase of the 5G cycle, with Greece (547.52Mbps) leading on median download speed in Q4 2024 thanks to its 3.5GHz usage, and Spain and Austria excelling in rural 5G SA coverage on the back of intensive deployments of the 700MHz band.

The next useful metric to check is latency (i.e. the response time between servers) and here the UK saw a median (average) 5G latency on older NSA networks of 47ms (milliseconds), while SA networks were able to achieve an even faster time of 35ms. However, once again, the UK is still far from being the fastest 5G SA or NSA country for latency performance.

Ookla adds that European operators at the forefront of business model evolution with 5G SA – “such as BT’s EE in the UK, Deutsche Telekom in Germany, Elisa in Finland, and 3 in Austria” – are said to be leveraging the technology to consolidate their positions at the premium end of the market and stimulate average revenue per user (ARPU) growth. But clearly the UK still has plenty of room for improvement.

In terms of performance, Ofcom currently has several auctions planned, which will release more radio spectrum for 5G mobile services, such as in the millimetre wave (mmW) friendly 26GHz and 40GHz bands (here). Some lower frequency mobile bands, such as in part of 6GHz, may also become available for use by mobile networks in the future. Suffice to say that this should help to boost 5G performance in the UK over the next few years.